What is the Child Care Subsidy?

The Child Care Subsidy (CCS) helps make early learning and childcare more accessible for Australian families. The Child Care Subsidy will be paid directly to your approved child care provider/s to reduce the fees you pay.

Check If You Are Eligible

Complete the activity test via the links below to see if you are eligible.

How does the Child Care Subsidy work?

The Child Care Subsidy will be paid directly to childcare providers to be passed on to families as a fee reduction. Families will contribute the difference between the provider fee charged and the subsidised amount. This is known as the families gap fee.

Calculate how much Child Care Subsidy your family could receive:

To calculate how much childcare subsidy you can receive at one of our daycare centres in Sydney, families can use the CCS Calculator at StartingBlocks.gov.au to estimate your childcare payments.

There are three factors that will determine your level of subsidy:

Our Family Relations Team can help you calculate an estimate for your subsidy, contact us for more information.

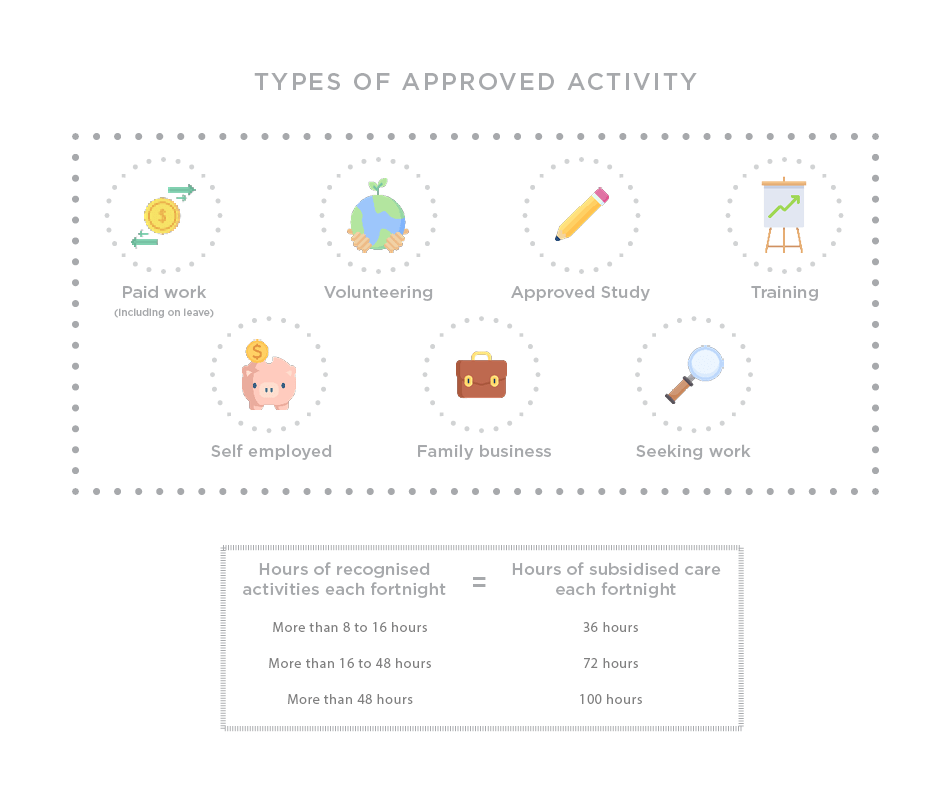

Activity level of parents

The number of hours of subsidised care families can access will be determined by an activity test. The higher the level of activity, the more hours of subsidised care families can access, up to a maximum of 100 hours per fortnight.

Extra support

Some families can get Additional Child Care Subsidy. It will be paid on top of Child Care Subsidy to provide extra support with child care fees.

There are 3 different types of Additional Child Care Subsidy that you can apply for. You can apply if you’re either:

- a grandparent

- transitioning to work

- experiencing temporary financial hardship.

Come and VISIT Active Kids

We are thrilled to invite you to come and visit any of our 15 locations

across Sydney and see which location suits you and your family best.